9/14/2023

New Comparability Plans: Add-on Feature Can Help You Save More

As we have seen in recent months and years, the hiring market can change significantly and rapidly. One proven way to attract and retain a talented workforce is by offering a robust benefits package and retirement plan options. A New Comparability Plan add-on can be utilized so that employers can create customized retirement plan contributions for different groups of employees, which allows them to reward select groups with higher contributions while still offering healthy employer contributions to other groups of employees.

WHAT IS A NEW COMPARABILITY PLAN?

A New Comparability (“New Comp”) Plan is an add-on feature to a 401(k) plan that can maximize retirement contributions for highly-compensated employees (HCEs) and owners regardless of how much non-HCEs save in the plan. New Comp Plans can help solve the problem many traditional 401(k) plans face when non-HCEs’ average savings rate is low, and discrimination testing forces HCEs and owners to save less than they would like. New Comp Plans are an enhancement that can provide benefits very efficiently to owners and HCEs who are facing this challenge. A New Comp Plan can also be set up as a standalone profit-sharing plan for employer contributions only.

A New Comparability (“New Comp”) Plan is an add-on feature to a 401(k) plan that can maximize retirement contributions for highly-compensated employees (HCEs) and owners regardless of how much non-HCEs save in the plan. New Comp Plans can help solve the problem many traditional 401(k) plans face when non-HCEs’ average savings rate is low, and discrimination testing forces HCEs and owners to save less than they would like. New Comp Plans are an enhancement that can provide benefits very efficiently to owners and HCEs who are facing this challenge. A New Comp Plan can also be set up as a standalone profit-sharing plan for employer contributions only.

HOW DO THESE PLANS WORK?

New Comp Plans allow employers to make separate retirement plan contributions for different groups of employees. Groups can be created for Owners, other HCEs and non-HCEs. Employees can also be grouped on other criteria based on business goals. For example, a company can create groups that are separated by job classifications or job titles. In all cases, contributions made to each group are allocated among the employees in each group based on salary.

WHAT TYPE OF BUSINESS SHOULD ADOPT THESE PLANS?

Because the Internal Revenue Code requires New Comp Plans to pass an annual discrimination test, these plans work best for employers whose owners and HCEs are older (on average) than the company’s other employees.

ARE CONTRIBUTION REQUIRED?

No. Contributions can be increased, decreased, or even eliminated in future years, making New Comp Plans very flexible for employers not wishing to make a commitment to an annual contribution.

ILLUSTRATION

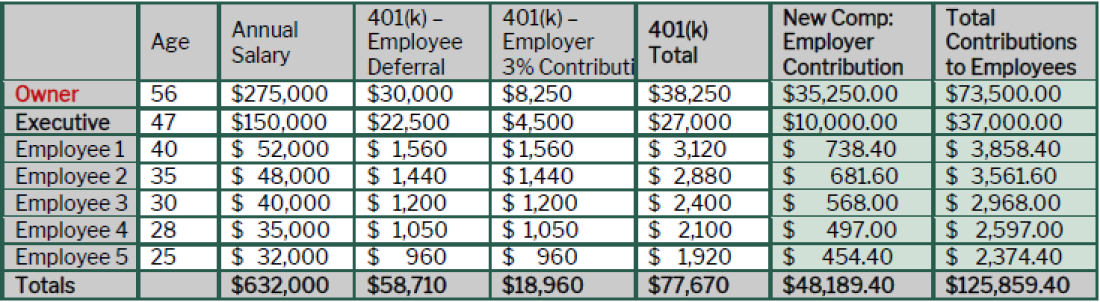

Depending on the company’s demographics, contributions to HCE accounts can be made efficiently while still providing benefits to non-HCEs and meeting testing requirements. The following example provides an illustration of how a New Comp Plan could work.

This example shows a company with one owner, one executive (HCE), and five other employees (non-HCEs) for a total of seven employees who are eligible to participate in the plan. The owner wanted to maximize her contributions to the retirement plan. She was able to adjust the executive’s New Comp contribution to an amount she wanted to bonus. In this scenario, the result is that the owner ends up with 69% of the New Comp contribution.

For more information on New Comp Plans or other assistance, please contact our Corporate Retirement Services team at 210–745–6393, toll-free at 1–888–757–2104, or [email protected].